4 APPS I USE TO MANAGE MY MONEY

Hey darling, welcome back ;)

This week was ALL about Money Management and I shared exactly how I personally manage my money on Instagram and with my Black Wealth Squad and today I want to share 4 apps I use to manage my money. And of course this super cute look. So let’s get right into it.

THE 4 APPS I USE TO MANAGE MY MONEY

- Square Payroll

- QuickBooks- Self-Employ

- Capitol One

- Bank of America – Spending & Budgeting

Square Payroll– Last year I spent some times separating my personal and business finance. And to properly keep them separate and manage my money I decided to put myself on payroll and I pay myself twice a week and I use Square Payroll to pay myself every single week.

Everything you need

to pay yourself and your team.

Tools that help you automatically

file payroll taxes, run payroll,

and manage employee benefits.

See how it works.

- Signup for Square Payroll and create your account.

- Choose payment method. Connect it to your business bank account

- Set up payroll. Check hours and earnings. How much do you you want to pay yourself per hour and how many hours do you work per week.

- Edit adjustments weekly as needed .

- Review each week.

- And Send Payroll.

I count on QuickBooks- Self-Employ for ALL of my BookKeeping needs and I use the App to keep track of EVERYTHING;

- Track my income & expenses

- Capture & organize my receipts

- Maximize every single tax deductions

- Track my miles

- Manage my cash flow

- Track sales & sales tax

- etc

QuickBooks- Self-Employ makes it super easy to integrate it with most if not all financial institution. You can literally connect your bank account and credit cards to automatically import and sort expenses into tax categories for more potential deductions. Sync with popular apps and snap photos of receipts.

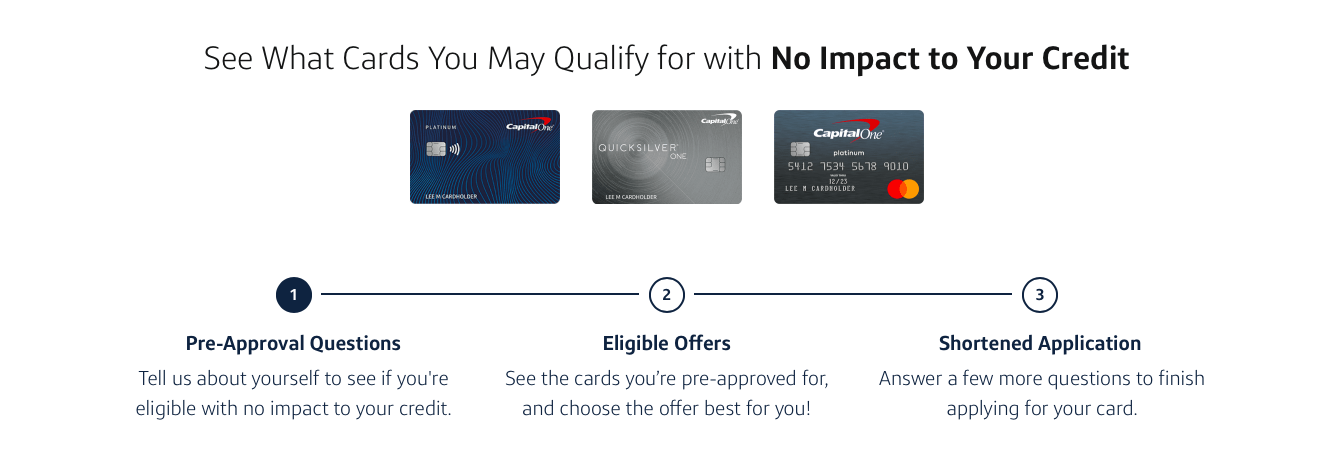

This year I am maximizing the HECK out of my credit and one thing I do is put every single thing I don’t need cash/debit for on my credit cards. And I’ve been able to use my Capitol One rewards to shop on Amazon, get free flights or even turned them into actual cash.

And I only have 3 credit cards. All with Capitol One. I’ve been with Capitol One for a while now and since then I’ve raised my credit score from 400 to 700. The Platinum card was my credit builder card and along the way Capitol One have offered me the QuickSilver and the Spark Business credit card. Whether you are looking to build or maintain credit Capitol One has a card for everyone.

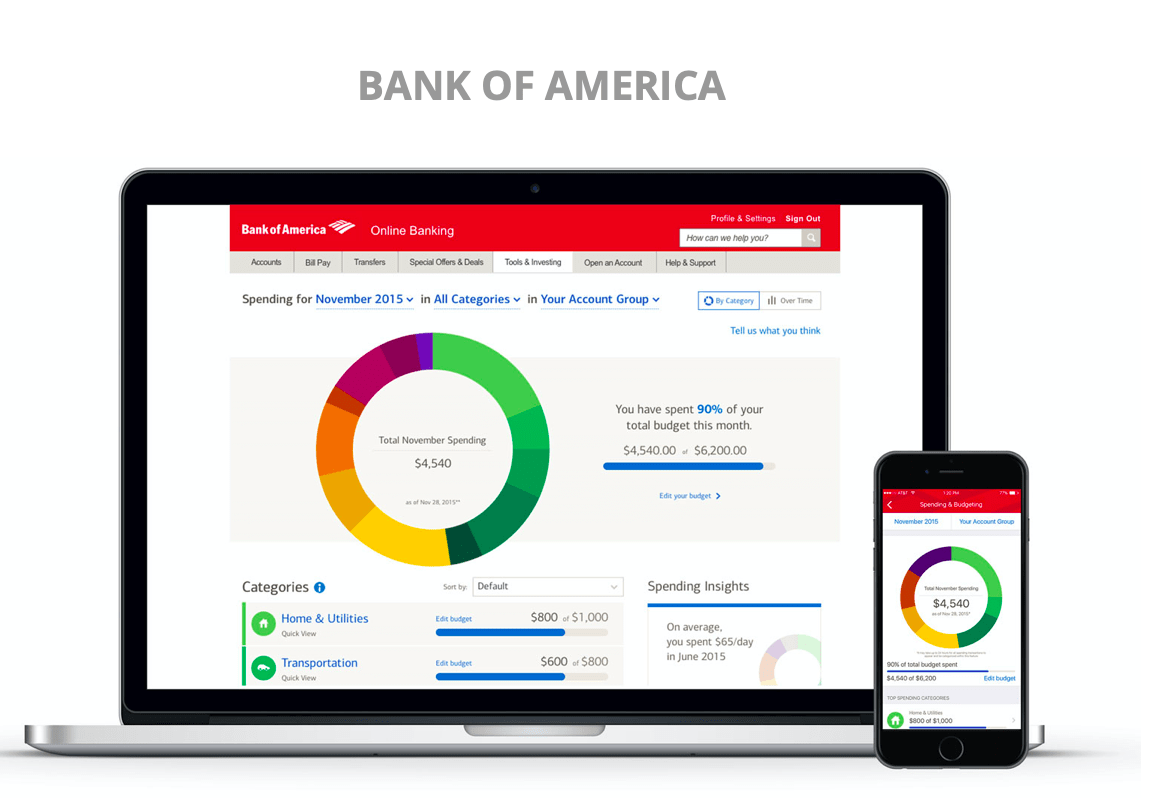

Bank of America Spending & Budgeting is an An award-winning budgeting tool that automatically analyzes expenses and spending trends to help users manage their finances.

The Spending & Budgeting feature comes with your Bank of America account so you must be a customer to use it. But it’s one of my favorite budgeting tools because it keeps me from over spending and have a clear picture of where my money goes each month.

First thing I do each month is creating a budget based on my needs for that month and then update each category with how much money I plan on spending per category. Meaning once I spend whatever that amount is, that’s it. I’m within my budget and I can’t spend anymore money. And I don’t play about my budget.

The Bank of America Spending & Budgeting feature does come with the personal and business account.

Ok, before I get out of here let’s talk about this LOOK!!! First, shoutout to my friends at Style 365 for sending me these FABULOUS faux-leather bell bottom pants, they are EVERYTHING!! They are sexy, comfy and soooooo stylish!!!

I decided to pair them with my Black Wealth Q1 Blue hoodie for an easy fun look and I added this cute pearl headband from Burlington to complete the look!!!

Ok babes, I truly hope this was helpful and if it was you can checkout the finance tab here for money tips and keep up with me on the gram, here.