REVIEW: ROBINHOOD PROS AND CONS

This post contains affiliate links

I did this post back in April 2020 and since I’ve been getting a lot of questions about what platform I use to invest figured I’ll update the post and republish it.

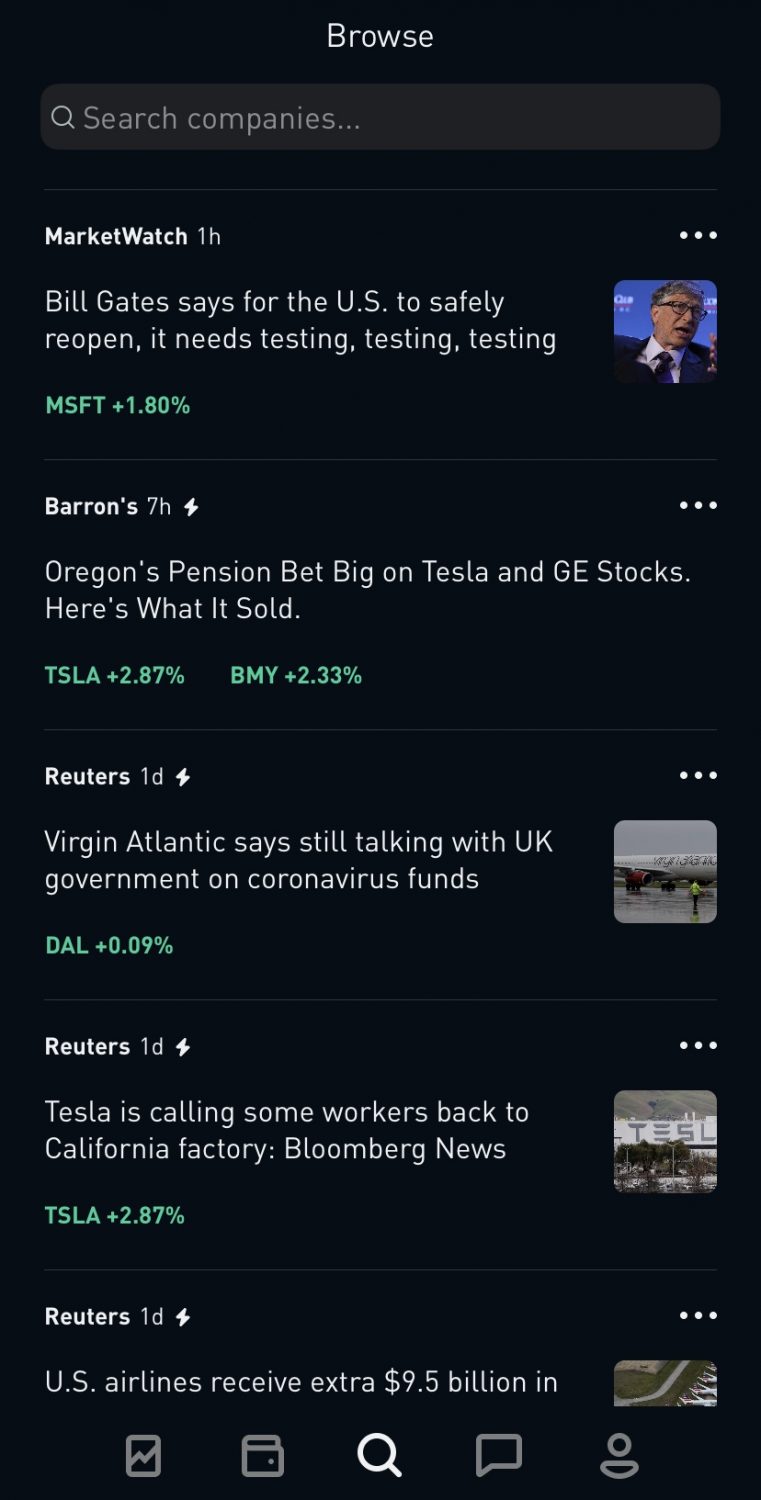

Hey, darlings, welcome back to the blog, I’ve been doing a lot of finance posts and I’m super excited to bring you a different finance post each and every week and this week we are talking about Stocks again! The #1 question I get ALL the time since I’ve been trading is what Broker do I use to trade stocks? And my answer is always the same, I use Fidelity to invest long-term and ROBINHOOD short-term. Meaning I spend way more time on Robinhood. So it’s time I do a full of Robinhood Pros and Cons review.

Why Robinhood?

There’s been a lot of negative talk about Robinhood but guess what? Because Robinhood let me trade COMMISSION FREE. I remember when I first got into the stock market back in 2015, I signed up with Scottrade (Which is now TD-Ameritrade), and not only did I need a minimum of $500 to open my investment account I was also paying a fee PER trade. So getting back into trading it was extremely important to me that I open my brokerage account somewhere I can trade for FREE. And Robinhood was the first company to offer COMMISSION FREE TRADING. AND Robinhood is literally the EASIEST platform to use. #ThankMeLater

Then my best friend invited me to ROBINHOOD. I was SOLD on the unlimited commission-free trades then I learned that I get a FREE stock for signing up. DOUBLE SOLD, lol. I was able to create an account and invite ALL of my wealthy besties to try Robinhood and get a FREE stock to start.

Buy your first stock

I do have a Full IGTV Video on how to use the Robinhood app and a full tour of how to use the app but here’s how to get started and buy your first stock

- If you don’t have a Robinhood account signup HERE

- Then decide what stock do you want to start with

- Go to the app

- Click on the search symbol

- Type the company’s name

- Select the company

- Then click on “Trade”

- Select BUY

- Put the number of shares you want

- Click on review

- Then Swipe up to submit

Robinhood Pros & Cons

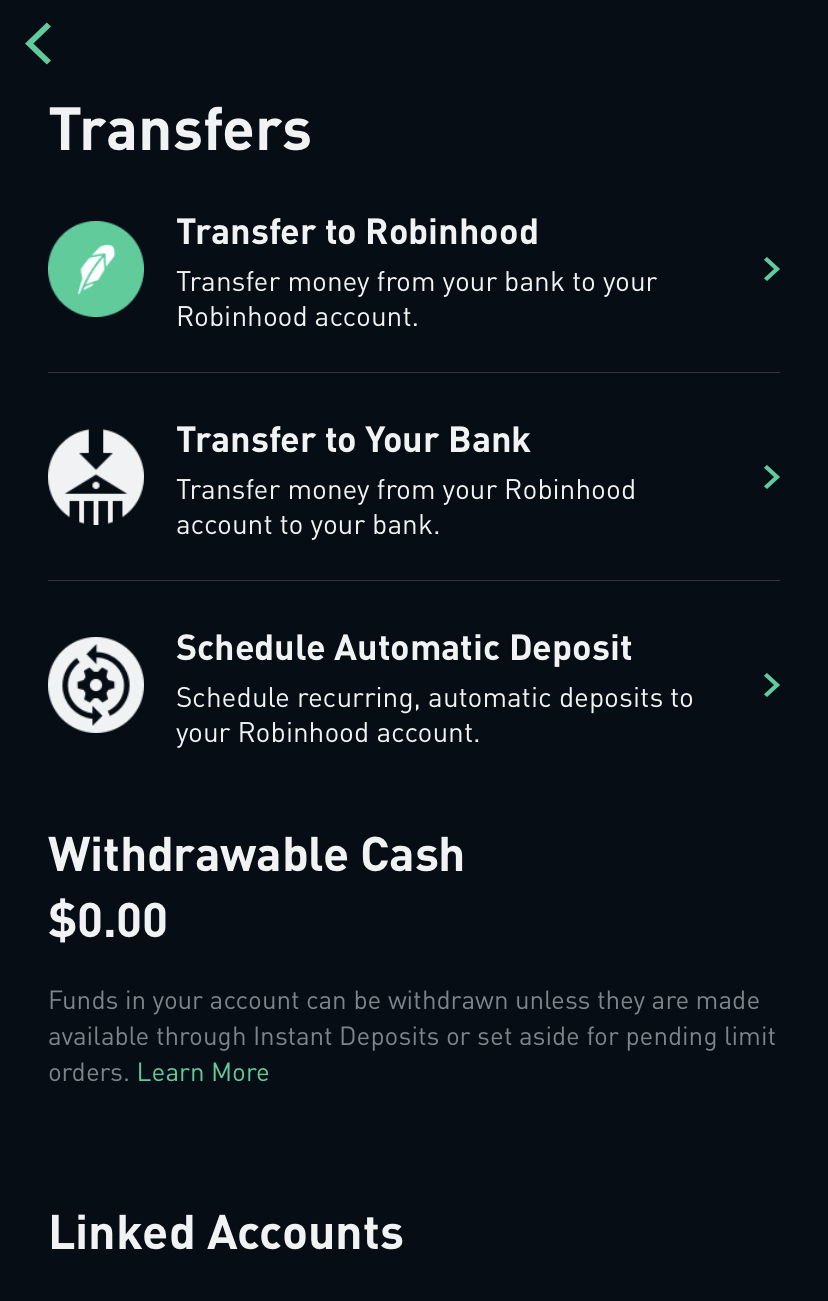

Like I said Robinhood offers commission-free US stock trading without withdrawal and inactivity fees. They offer both mobile and web trading platforms that are super easy to use. Opening an account was seamless and extremely fast. Those few things were my off-the-back PROS.

Pros

Cons

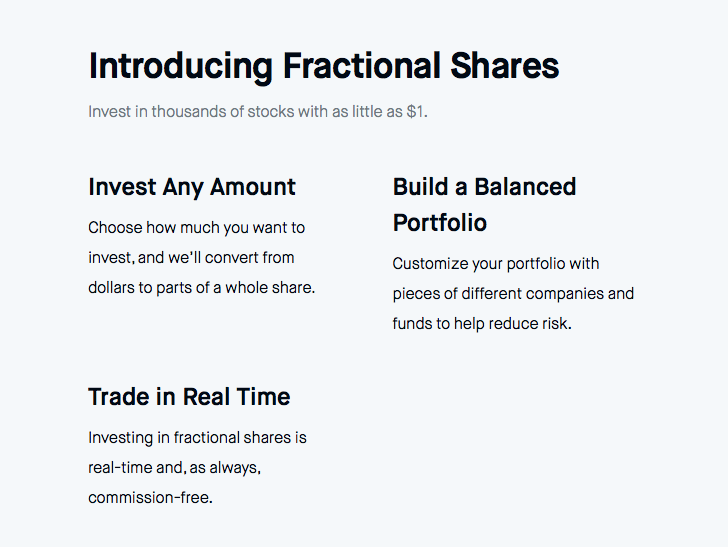

I do wish Robinhood offered more educational materials within the app but honestly other than that, the only con I have actually been added to the platform. Robinhood now offers FRACTIONAL SHARES!! Pretty much a fractional share is a portion of an equity stock that is less than one full share.

Meaning you can buy a small fraction of stocks you feel like you can’t afford. For example: let’s say Tesla is currently at $725 and you don’t have $725 to invest right now on ONE share you can buy a fraction of the $725 instead.

Also recently added to the platform

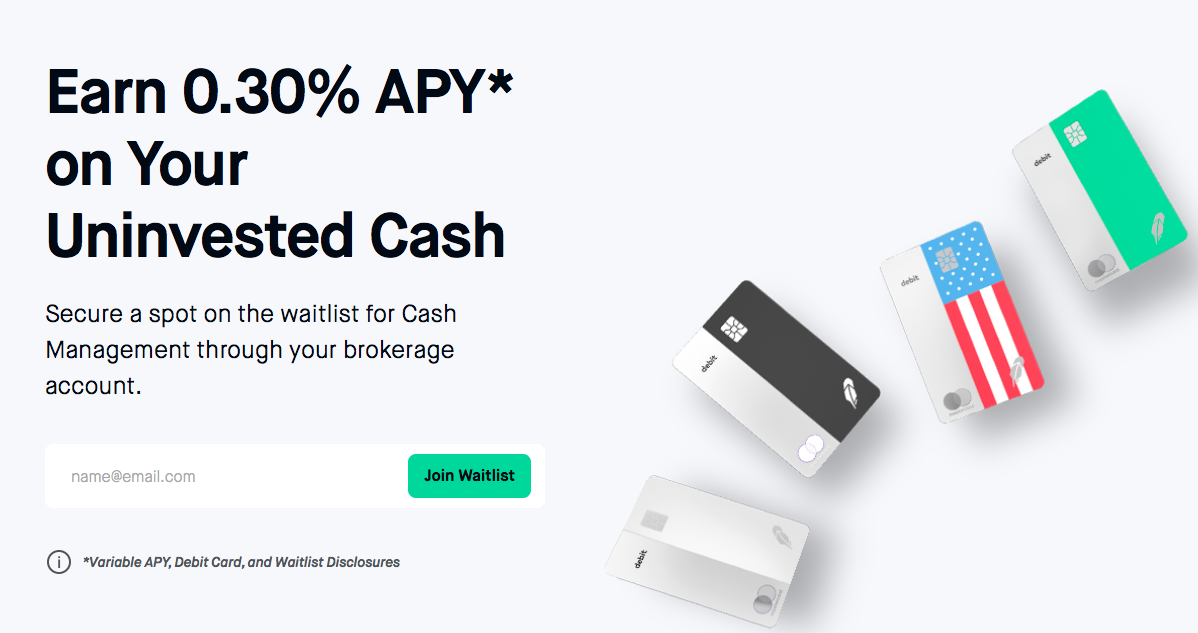

When I did this post last year something I was waiting for and looking forward to in the Robinhood app is the CASH MANAGEMENT card! AND THE CASH MANAGEMENT CARD IS HERE!!! So not only dol I have a card to use to trade I now have instant access to my gains. So in a way the future is officially here!!!

Overall Robinhood is easy to use and currently meets all of my needs as a trader and perfect for a new investors! And honestly compared to all the other brokers out there choosing ANY of them is a personal preference.

Tanesha

April 28, 2020This is so good. I’m on the road to a healthier relationship with money and with investing. This article was right on time for I’ve been looking into TD AmeriTrade. I’m going to check out Robinhood as well as watch your IGTV talking on it.